UP TO THE MINUTE

Understand how credit card fees benefit your margin for roofing success

By Lauren Miller, JobNimbus.

Roofers can boost their bottom line by incorporating credit card fees into their pricing, ensuring seamless payments and happier customers.

Getting paid can become a challenge without the right payment procedures. That is why including credit card fees into transaction fees for customers will aid in being more transparent and largely improve the customer experience as well as your own peace of mind. The team at JobNimbus is here to help you understand how credit card fees work, which will boost your confidence moving forward and make sure you have a better experience with customer transactions.

The basics of credit card fees

What are credit card processing fees?

Credit card processing fees are the amount credit card issuers or payment processors charge merchants each time the business accepts a credit card payment. These fees are required to process and authorize transactions.

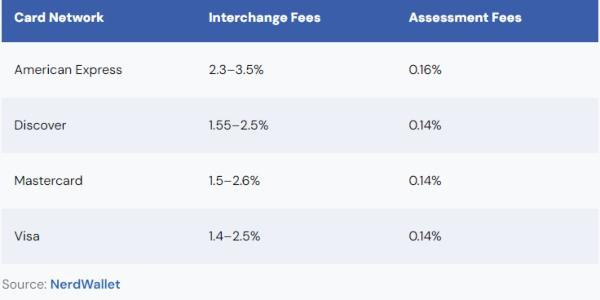

On average, credit card fees are typically around 1–3.5%, depending on the credit card issuer. Take a look at the chart below to see what different credit card companies charge on average per transaction.

Who pays credit card transaction fees?

Merchants accepting the payments are typically responsible for paying any fees associated with credit card transactions. In some cases, business owners can surcharge customers the cost of the fee.

Business owners can also include credit card fees in their margin as they determine the operating cost of their service.

Is it legal to charge a credit card fee?

In most U.S. states, it is legal to surcharge customers for credit card fees. The following states currently have restrictions regarding credit card fee surcharges:

- California

- Georgia

- Indiana

- Iowa

- Michigan

- New York

- Ohio

- Oklahoma

- Pennsylvania

- Texas

In the U.S., businesses can’t surcharge customers more than the amount of the credit card fees.

Three benefits of building credit card fees into your margin

Now that you understand credit card fees, let’s look into the benefits of building credit card fees into your margin.

1 - Your price is set

When your pricing accounts for all fees upfront, it leaves less room for disagreements.

With an itemized fee list, customers are more likely to try and negotiate your price down. Instead, all your costs and fees are included in your pricing structure and represent the cost of your service as a whole.

Pricing can be a tricky thing. Consumers often perceive prices differently, even if the final cost stays the same.

For example, you might think paying $2 for a left sock and an extra $2 fee for the right sock is ridiculous. But you probably wouldn’t bat an eye at paying $4 for a pair of socks. It’s all about the perception of what you’re paying for.

It’s the same concept as free delivery. You might scoff if you see a product for $10 with a $5 delivery fee. However, most people wouldn’t mind paying $15 for a product with free delivery.

We think we’ve scored a deal with free delivery, even though the final cost is the same. The sellers likely built the delivery cost into the price of the $15 product, but we don’t like paying “extra” to cover delivery for the $10 product.

Often, people would rather have one all-inclusive price rather than an itemized list of extra fees. Customers are less likely to question the cost of your service without small fees listed.

2 - Better customer experience

No one likes surprise fees. People feel nickel and dimed when they see a small percentage fee on their bill to account for the credit card fees. Instead, customers are happier paying for your expert roofing services versus covering various operating cost fees.

3 - Ensure the fee is collected

When you build the credit card fee into your margin, you know the credit card fee will be collected and paid. You don’t need to worry about the fees for each transaction—it’s all accounted for in your margin.

Tracking financials for your roofing business

Mastering credit card payments isn’t the only way to set your roofing business up for success. To ensure your finances are in a good place, read JobNimbus’s post to learn five ways to improve your roofing business’s cash flow.

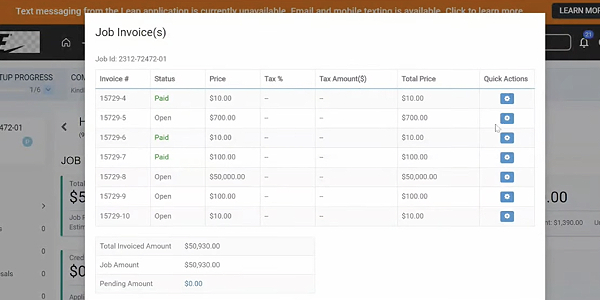

To help you stay on the right track with all of your business’s financial needs, use a payment processor like JobNimbus Payments.

Try out JobNimbus Payments in our sandbox to see how a payment processor can level up your financial game today!

Original article source: JobNimbus

Learn more about JobNimbus in their Coffee Shop Directory or visit www.JobNimbus.com.

Comments

Leave a Reply

Have an account? Login to leave a comment!

Sign In